Surviving a Bear Market

Most headlines have some type of reference to market volatility, how to survive, what you should do in a “down market”. Reading the paper everyday is depressing and if you follow the headlines you feel as if you should be doing something.

Volatility is tough, here are a few simple tips to ride it out.

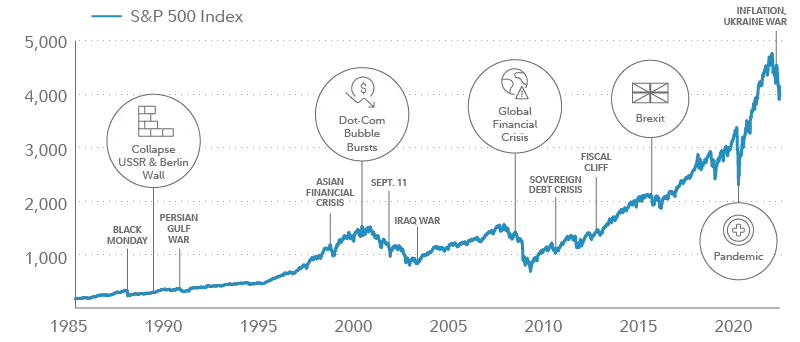

Market Volatility is Part of the Normal Financial Cycle

Although volatility might be new to you, it is not new. Consider the chart below, if you have time the market has been positive over time. What goes down, does come back up. (Note if you are properly diversified).

Source: Fidelity Investments. Past performance is no guarantee of future returns.

Evaluate the composition of your portfolio

Evaluate the amount of risk you have in your investment portfolio. When the market has a positive run, your portfolio can become out of balance. Is your asset allocation appropriate given the amount of risk you want to take?

In a 2001 Berkshire Hathaway investor letter, Warren Buffett wrote, “After all, you only find out who is swimming naked when the tide goes out.”

A negative market is an excellent time to evaluate the success of an investment program and your risk appetite.

There are ways to shift asset allocation gracefully. For example, Tech stock heavy- well now might not be the time to sell but consider owning a smaller share.

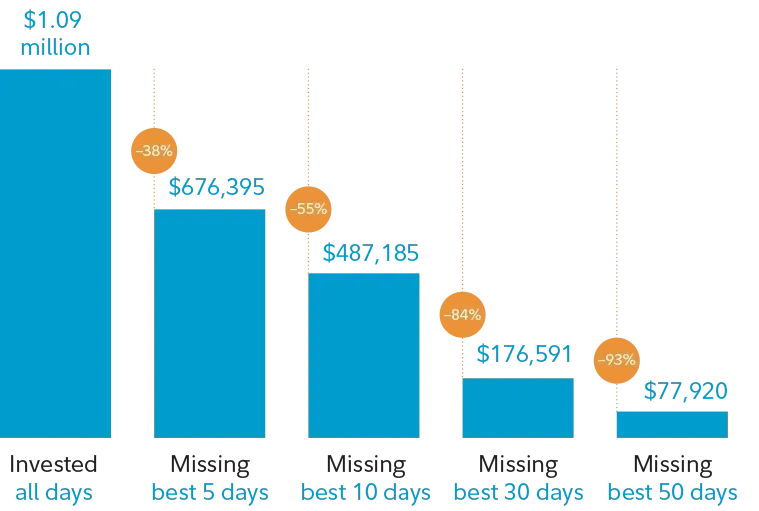

Do not try to time the market – wait it out

Continue investing- don’t pull your 401K allocation and don’t switch the allocation to cash. (That is unless you are retiring and will need the money in the next few years) – this is a longer-term allocation. Look at the graph below and the impact to the investment portfolio by just missing the best 5 days in the market!

Missing out on best days can be costly

Hypothetical growth of $10,000 invested in the S&P 500 Index, January 1, 1980–March 31, 20213

Past performance is no guarantee of future returns. Source: FMRCo, Asset Allocation Research Team, as of March 31, 2021.

Spend smart and think about a budget

Every purchase we make is a lot more expensive today than even 6-12 months ago. Whether you think we are in a recession or will be soon, it is time to evaluate how we spend our money. Making small changes can have a big impact. In a situation where we have no control, these small changes allow you take back some control in your monthly budget.

Think about purchases

o Do we really need more stuff? Turn off the email ads that are sent to your inbox multiple times a day. A 50% off sale is still not free! When you do shop- shop small and local! A few well thought out and quality purchases will get you through.

o Subscriptions when was the last time you used Hulu, Netflix, and YouTubeTV? Can you cut back?

o Meal Planning – think about the week when you buy groceries.

Cuts back on food waste

We tend to order out or go out when we come home and “there is nothing to eat”.

So I am not saying don’t look- yes, look, but understand markets historically rise, market timing is impossible, and by budgeting and spending wisely we can take back control of what might feel is an out-of-control downward spiral.